What is FinanceOps?

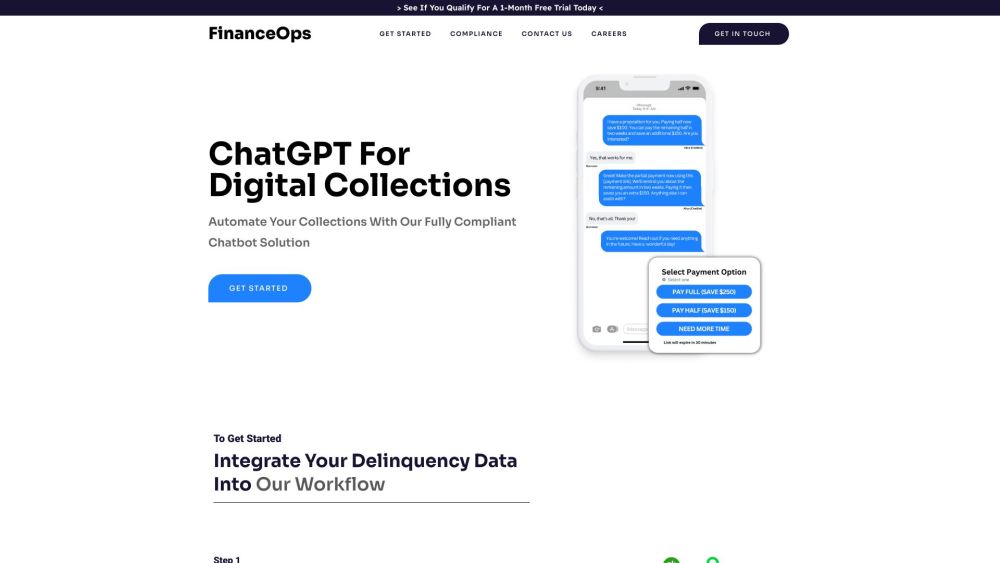

FinanceOps is a comprehensive financial operations platform designed to revolutionize the collections process through AI-driven automation. This platform seamlessly integrates with leading ERP systems, using cutting-edge algorithms to enhance efficiency and maximize outcomes. FinanceOps empowers businesses by simplifying collections, delivering customized interactions, reducing operational costs, handling higher transaction volumes, and ensuring strict adherence to US debt collection regulations.

How to Use FinanceOps?

To get started with FinanceOps, follow these straightforward steps: 1. Connect your ERP system: Easily link FinanceOps with your existing ERP system for a smooth transition. 2. Import delinquency data: Seamlessly integrate and configure your delinquency data from ERP systems like QuickBooks, Xero, Sage, NetSuite, Salesforce, and more within the FinanceOps dashboard. 3. Customize your collections strategy: Tailor your approach by setting preferences for communication tone, loan parameters, and settlement thresholds. 4. Activate Autopilot: Allow FinanceOps to manage your collections with its AI-powered system that applies advanced algorithms and personalized strategies to optimize results and engage customers effectively.