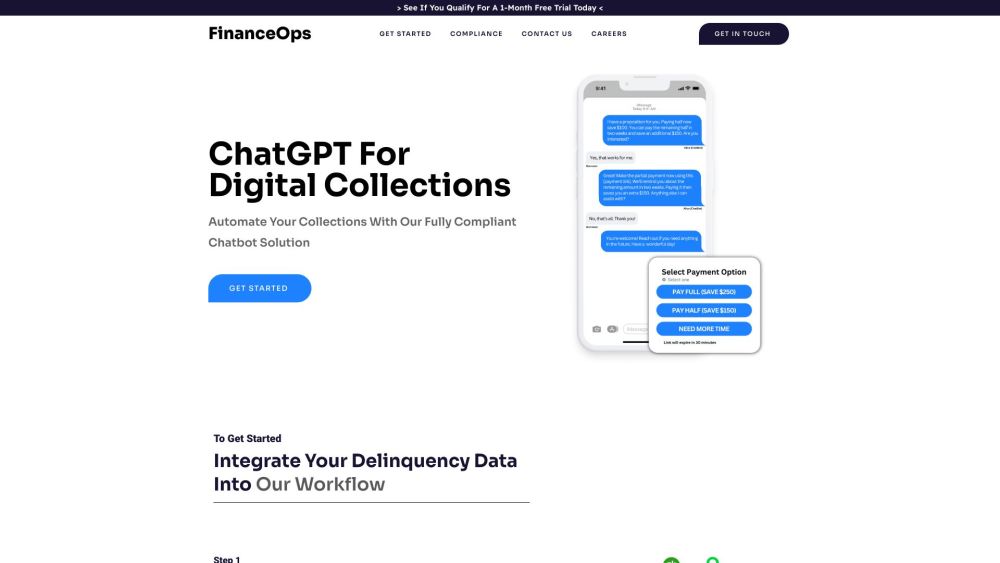

FinanceOps: Automate Collections & Maximize Results with AI Chatbot

FinanceOps: Streamline collections and boost outcomes with our AI-powered chatbot. Automate processes, save time, and enhance financial efficiency.

What is FinanceOps?

FinanceOps is a comprehensive financial operations platform designed to revolutionize the collections process through AI-driven automation. This platform seamlessly integrates with leading ERP systems, using cutting-edge algorithms to enhance efficiency and maximize outcomes. FinanceOps empowers businesses by simplifying collections, delivering customized interactions, reducing operational costs, handling higher transaction volumes, and ensuring strict adherence to US debt collection regulations.

How to Use FinanceOps?

Key Features of FinanceOps

Seamless ERP Integration

Precise Data Mapping and Configuration

Compliance with US Debt Collection Laws (FDCPA, CPA, CCPA)

Customizable Collection Strategies

Automated and Streamlined Operations

Targeted Customer Engagement

24/7 Support for Collections via SMS

Escalation to Live Agents When Necessary

Cost-Efficient with Reduced Overheads

Scalability to Manage Growing Volumes

Use Cases of FinanceOps

Automate Repetitive Collection Tasks

Enhance Operational Efficiency and Effectiveness

Personalize Interactions for Better Customer Experience

Mitigate Compliance Risks with Adherence to Legal Frameworks

Focus on Core Business by Offloading Collections Work

-

FinanceOps Support Contact Information

For support, visit the contact us page.

-

About FinanceOps

Learn more about FinanceOps by visiting the about us page.

-

FinanceOps on YouTube

Watch more on FinanceOps' YouTube channel: https://www.youtube.com/watch?v=MLpWrANjFbI.

FinanceOps FAQ

What is FinanceOps?

FinanceOps is a financial operations platform designed to automate collections using an AI-driven chatbot. It integrates with major ERP systems, utilizing advanced algorithms to enhance collections and drive results. The platform is focused on efficiency, tailored interactions, cost reduction, and compliance with US debt collection laws.

How to use FinanceOps?

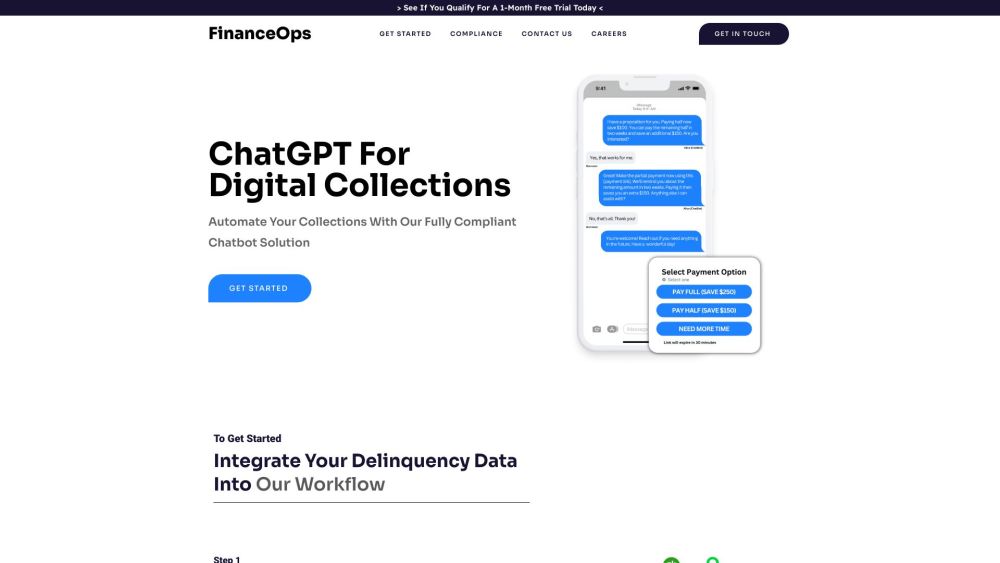

To use FinanceOps: 1. Link your ERP system: Start by connecting your existing ERP tool to FinanceOps. 2. Import delinquency data: Bring your delinquency data into the FinanceOps dashboard from ERP systems like QuickBooks, Xero, Sage, NetSuite, Salesforce, etc. 3. Customize collections settings: Adjust settings such as communication tone and settlement criteria. 4. Start Autopilot: Allow FinanceOps to handle collections with its AI-powered strategies and optimization techniques.

Which ERP systems are compatible with FinanceOps?

FinanceOps integrates seamlessly with ERP systems such as QuickBooks, Xero, Sage, NetSuite, Salesforce, and more.

What data can be managed in FinanceOps?

FinanceOps allows you to manage and configure data including customer details, invoices, payment history, aging reports, communication logs, and account statuses.

Does FinanceOps adhere to debt collection laws?

Yes, FinanceOps is fully compliant with US debt collection regulations, including FDCPA, CPA, and CCPA.

Does FinanceOps offer customer support?

Yes, FinanceOps provides 24/7 SMS support for collections inquiries. The chatbot is equipped to manage a wide range of first-party collection tasks.

Is FinanceOps cost-effective?

Yes, FinanceOps reduces operational expenses by automating collections, optimizing interactions, and lowering overhead costs.