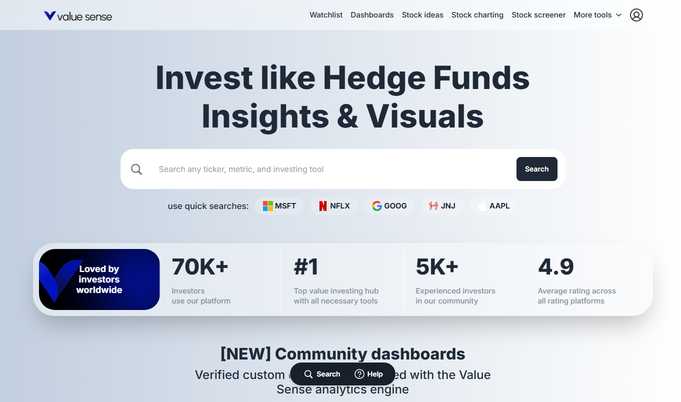

Value Sense: Intrinsic Valuation, Earnings Insights, Value Investing Tools

Discover undervalued stocks with Value Sense—your all-in-one platform for intrinsic valuation, earnings insights, and value investing tools to outperform the market.

Think Like the Pros

Value Sense empowers investors with advanced tools and actionable insights to evaluate stocks like seasoned hedge fund analysts. Our platform delivers in-depth intrinsic valuation models, real-time earnings intelligence, and time-tested value investing strategies to help you uncover opportunities others overlook.

Core Features of Value Sense

Advanced Valuation Models

Go beyond surface-level metrics with proprietary tools that estimate a stock’s true worth using discounted cash flow, comparative analysis, and historical benchmarks.

Custom Community Dashboards

Tap into powerful dashboards built by experienced investors using our proprietary analytics engine for tailored market insights.

Peer-to-Peer Comparison Tools

Benchmark leading companies like Apple, Alphabet, and Microsoft across key financial and operational metrics.

Business Segment Analysis

Break down revenue streams and profitability drivers for major sectors including cloud computing, advertising, and hardware.

Global Risk Exposure Reports

Understand geographic revenue distribution and assess exposure to regions such as China for companies like Tesla, AMD, and Apple.

Smart Stock Screeners

Filter stocks based on value metrics like P/E ratios, dividend yields, and return on invested capital to find hidden opportunities.

Live Market Movers

Stay ahead of volatility with up-to-the-minute updates on the most impactful market movements and news events.

Responsive Design

Access all tools seamlessly on your desktop, tablet, or smartphone with full cross-browser compatibility.

Global Market Data

Explore financial information across major exchanges including NYSE, NASDAQ, and global indices with precision and depth.

Custom Alerts System

Set personalized notifications for valuation changes, earnings reports, or significant price movements.

Portfolio Valuation Tools

Compare your current holdings to intrinsic value benchmarks and discover optimization strategies for better returns.

Historical Trend Analysis

Review long-term financial performance and valuation trends to support informed investment decisions.

Upcoming Earnings Calendar

Plan your trades with a comprehensive schedule of upcoming quarterly reports for stocks you follow.

Dividend Sustainability Reports

Identify high-yield dividend stocks with strong fundamentals and consistent payout histories.

Relative Valuation Comparisons

Assess how stocks measure up against industry averages and uncover undervalued opportunities.

Technical & Fundamental Fusion

Combine technical indicators with fundamental data to enhance timing and strategy development.

Insider Activity Tracking

Monitor insider buying and selling to detect potential shifts in company sentiment.

Deep Financial Statement Analysis

Review income statements, balance sheets, and cash flow reports in detail to understand company health.

Who Can Benefit?

Value Sense is built for a wide range of investors who seek to make smarter, more informed decisions grounded in fundamental value and intrinsic worth.

Disciplined Value Investors

Individuals applying Benjamin Graham and Warren Buffett principles to find undervalued, high-quality businesses.

Long-Term Wealth Builders

Investors focused on compounding gains by holding fundamentally sound companies at a discount.

Income-Oriented Investors

Those seeking reliable dividend payers with strong fundamentals and sustainable payout ratios.

Professional Analysts

Financial experts looking for robust data and valuation tools to enhance their research and reporting capabilities.

With Value Sense, you can cut through the noise and focus on what truly matters—real value and long-term growth potential.

What Makes Value Sense Unique?

In a world where market sentiment often overshadows fundamental value, Value Sense gives you the clarity to see beyond the hype. We combine cutting-edge valuation models with user-friendly tools to help you identify stocks trading below their true worth. By focusing on fundamentals, financial health, and long-term trends, our platform equips you to make smarter, more confident investment decisions with a built-in margin of safety.

How to Get Started

Value investing is both a strategy and a mindset. With Value Sense, we provide the tools to simplify the process while delivering the depth of analysis you need to succeed.

Step 1: Discover Hidden Opportunities

Browse our handpicked list of undervalued stocks across multiple sectors and market caps...

Step 2: Evaluate Intrinsic Value

Use our proprietary models to estimate fair value and determine whether a stock is over or undervalued...

Step 3: Compare Against Industry Standards

See how your picks stack up against competitors and industry averages to assess relative value...

Step 4: Create and Track Your Watchlist

Build a personalized watchlist and set alerts to stay informed of ideal entry points...

Key Advantages

Easy-to-Use Interface

No finance degree needed. Complex data is presented clearly through intuitive dashboards and visual reports.

Global Market Coverage

Analyze stocks from major exchanges across the U.S., Europe, Asia, and emerging markets.

Multi-Device Compatibility

Access your data anytime, anywhere—on desktop, mobile, or tablet with full browser support.

Real-Time Data Updates

All data and analysis are refreshed regularly to reflect the latest earnings reports and market changes.

Secure and Private

Your portfolio and watchlist data are encrypted and accessible only to you.

Market Intelligence Hub

Frequently Asked Questions

What is intrinsic value and why does it matter?

How often is your financial data refreshed?

Can I analyze my current portfolio using your tools?

Is Value Sense appropriate for new investors?

How do you determine if a stock is undervalued?

Unlock the power of value investing and build a smarter, more resilient portfolio with Value Sense.

© 2025 valuesense.io. All rights reserved.

By using valuesense.io, you agree to our Terms and have read our Privacy Policy and Cookies Policy