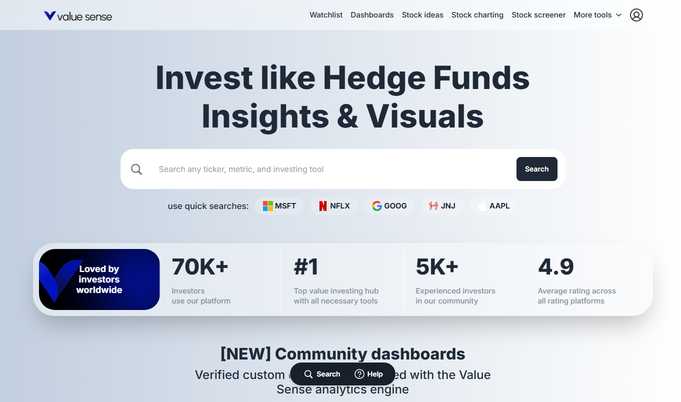

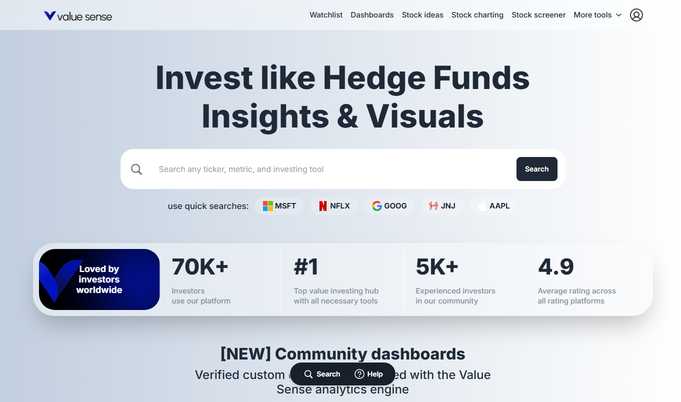

Value Sense: Intrinsic Valuation, Earnings Reports, Beat Market Tools

Discover undervalued stocks with Value Sense, the ultimate stock analysis platform for savvy investors. Unleash intrinsic valuation, earnings insights, and value investing tools to outperform the market. Empower your portfolio today!

Empower Your Investments with Data

With Value Sense, you can unlock the same advanced insights and tools that professional investors rely on to uncover hidden opportunities in the market. Our platform delivers detailed intrinsic valuation models, comprehensive earnings reports, and strategic frameworks designed to help you identify undervalued stocks before the broader market does.

Key Features of Value Sense

Intrinsic Valuation Models

Access cutting-edge algorithms that calculate a stock's true value beyond its current trading price, helping you make smarter investment decisions.

Customizable Dashboards

Create personalized dashboards tailored to your investment strategy, featuring real-time data and metrics from our robust analytics engine.

Sector Comparisons

Analyze how leading companies like Amazon, Microsoft, and Alphabet stack up against each other in terms of growth, profitability, and technological investments.

Earnings Segment Breakdowns

Gain a deeper understanding of how various business segments contribute to a company’s overall financial performance, such as cloud services, advertising, or hardware sales.

Geopolitical Exposure Analysis

Track the revenue exposure of major corporations to key regions like China, including tech giants like NVIDIA, Apple, Tesla, and Qualcomm.

Undervalued Stock Filters

Use specialized screeners to find promising stocks based on criteria like dividend yield, low P/E ratios, and high return on invested capital (ROIC).

Market Activity Tracker

Stay updated with live notifications about significant market movements and trends affecting your portfolio.

Multi-Device Accessibility

Seamlessly access Value Sense features across all devices—desktops, tablets, and smartphones—for uninterrupted analysis.

Extensive Financial Database

Leverage an expansive library of financial data covering global exchanges and markets to inform your decisions.

Personalized Alerts

Set custom alerts for stock price changes, valuation updates, or upcoming earnings announcements so you're always one step ahead.

Portfolio Optimization Tools

Assess your existing holdings using intrinsic value metrics and identify areas for improvement within your investment strategy.

Historical Performance Insights

Examine long-term patterns and key performance indicators to refine your approach to investing over time.

Who Benefits from Value Sense?

Value Sense caters to a wide range of users who want to harness the power of fundamental analysis and intrinsic valuation:

Value-Oriented Investors

Adherents of Benjamin Graham and Warren Buffett's philosophies seeking underappreciated companies with strong fundamentals.

Long-Term Wealth Builders

Individuals focused on building lasting wealth through carefully selected positions in high-quality businesses trading below their intrinsic worth.

Income Investors

Those aiming to generate steady income via undervalued dividend-paying stocks with solid track records.

Professional Analysts

Experts requiring thorough financial data and valuation tools to enhance their research capabilities.

By leveraging Value Sense, you'll gain the ability to pinpoint overlooked opportunities and base your decisions on concrete intrinsic values rather than fleeting market sentiment.

How to Leverage Value Sense

To maximize the benefits of Value Sense, follow these straightforward steps:

Step 1: Discover Potential Stocks

Review our categorized lists of undervalued stocks spanning multiple industries and sectors.

Step 2: Conduct In-Depth Valuation

Delve into individual equities with our sophisticated valuation techniques and relevant metrics.

Step 3: Benchmark Against Competitors

Measure relative attractiveness by comparing critical factors against industry norms.

Step 4: Curate Your Watchlist

Add potential buys to your watchlist and configure alerts for optimal buying moments.

Advanced Platform Highlights

User-Friendly Design

No prior finance experience necessary—our intuitive interface simplifies complex information into digestible formats.

Global Market Coverage

Examine stocks listed on prominent exchanges worldwide, including NYSE, Nasdaq, and others.

Seamless Integration

Experience consistent functionality whether you're working on a desktop, tablet, or mobile device.

Continuous Updates

Data and analyses are refreshed regularly to align with evolving market dynamics and corporate disclosures.

Robust Security Measures

Your private data remains safeguarded at all times, ensuring confidentiality and peace of mind.

Insightful Market Reports

Commonly Asked Questions

What constitutes intrinsic value assessment?

How frequently is the data renewed?

Am I able to monitor my present portfolio?

Is Value Sense appropriate for novice investors?

What methodology do you employ to detect undervalued stocks?

Uncover equities trading below their intrinsic value and construct a portfolio geared toward outperforming the market in the long run.

© 2025 valuesense.io. All rights reserved.

By utilizing valuesense.io, you consent to our Terms and Conditions and acknowledge having reviewed our Privacy Policy and Cookies Policy.