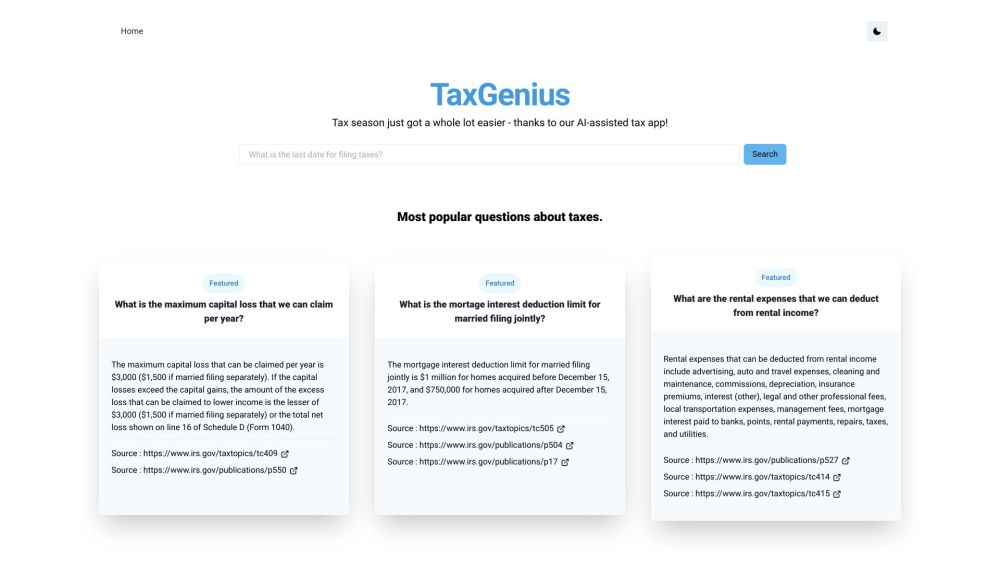

TaxGenius: AI-Assisted Tax App for Easy Filing and Quick Answers

Simplify tax season with TaxGenius: the AI-powered app providing quick answers and effortless tax filing. Make taxes easy and stress-free!

What is TaxGenius?

TaxGenius is an innovative tax application powered by artificial intelligence, designed to simplify the process of tax filing and provide quick, reliable answers to your tax-related inquiries.

How to use TaxGenius?

TaxGenius's Core Features

AI-driven tax assistance

Reliable and current tax data

Access to popular tax FAQs

In-depth exploration of tax topics

Immediate responses to tax queries

TaxGenius's Use Cases

Obtaining swift answers to tax questions

Clarifying intricate tax matters

Learning about deductions, credits, and limits

Optimizing your tax savings

FAQ from TaxGenius

What is TaxGenius?

TaxGenius is an AI-assisted tax app designed to make tax season easier for users. It leverages the power of AI technology to answer tax-related questions.

How to use TaxGenius?

Using TaxGenius is simple. Just open the app, enter your tax question, and let the AI technology provide you with the answer. You can search for the most popular questions about taxes or explore various tax topics for detailed information.

What is the maximum capital loss that can be claimed per year?

The maximum capital loss that can be claimed per year is $3,000 ($1,500 if married filing separately).

What is the mortgage interest deduction limit for married filing jointly?

The mortgage interest deduction limit for married filing jointly is $1 million for homes acquired before December 15, 2017, and $750,000 for homes acquired after December 15, 2017.

What are the rental expenses that can be deducted from rental income?

Rental expenses that can be deducted from rental income include advertising, auto and travel expenses, cleaning and maintenance, commissions, depreciation, insurance premiums, interest (other), legal and other professional fees, local transportation expenses, management fees, mortgage interest paid to banks, points, rental payments, repairs, taxes, and utilities.