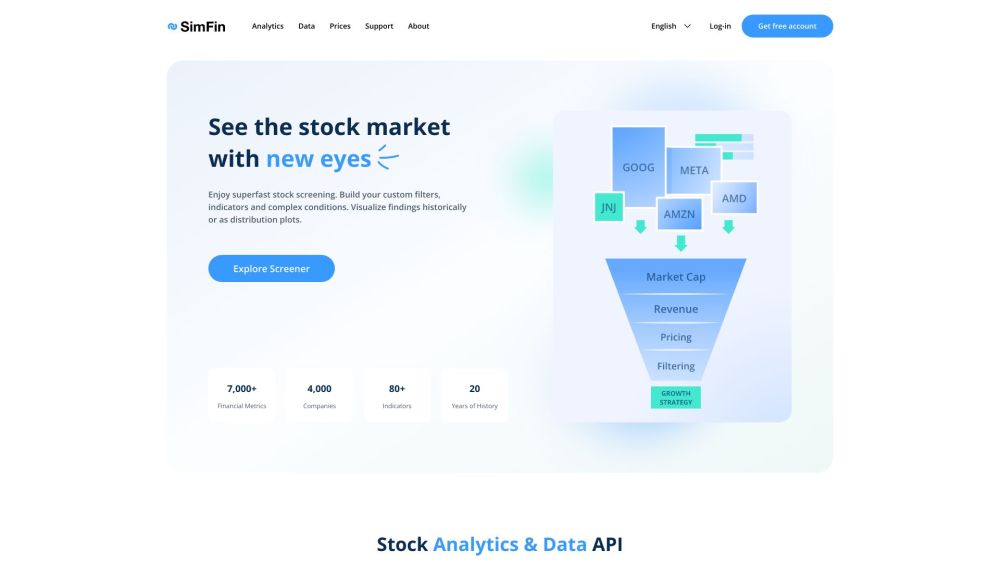

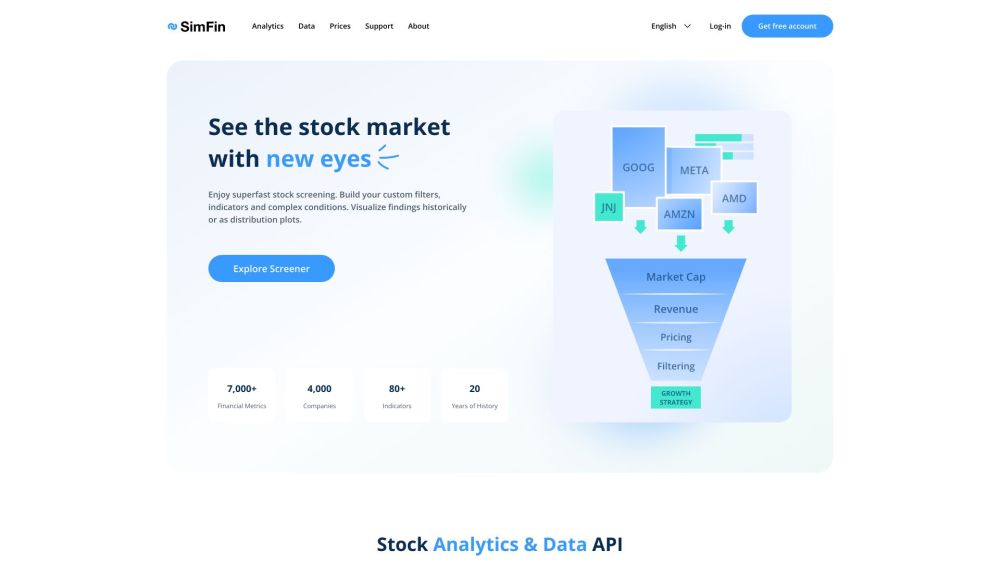

SimFin: Stock Analysis, Backtesting, 5000+ Stocks Data Access Tools

Unlock financial insights with SimFin: Stock Analysis, Backtesting, and access to 5000+ stocks data. Optimize investments with advanced tools and fundamental data.

What is SimFin?

SimFin is an advanced stock analysis platform that provides a comprehensive suite of tools for financial data insights, portfolio analysis, and backtesting. With access to data for over 5,000 stocks, SimFin enables users to conduct in-depth stock screening, backtesting, and fundamental analysis, making it a vital resource for investment professionals.

How to use SimFin?

SimFin's Core Features

Stock screening with custom filters and indicators

Backtesting of single stocks and complex strategies

API and bulk-CSV data download

Access to over 7,000 financial metrics of 5,000+ companies

Visualization of market data with various chart types

Comparative analysis using custom metrics

Sharing insights and strategies with the community

Integration with Python and Excel for advanced data analysis

SimFin's Use Cases

Enhancing investment strategies with advanced stock screening and backtesting

Visualizing and analyzing historical stock market data

Creating custom filters and indicators for data-driven investment decisions

Developing and sharing investment studies and strategies

Utilizing SimFin data for stock value analysis and prediction

Improving portfolio analysis and asset allocation

SimFin Support Email & Customer service contact & Refund contact etc.

For more information, visit the contact us page(https://www.simfin.com/en/contact/).

SimFin Company

SimFin Analytics GmbH is based in Halle (Saale), Germany.

Learn more about SimFin by visiting the about us page(https://www.simfin.com/en/about/).

SimFin Login

Log in to SimFin at https://app.simfin.com.

SimFin Sign up

Sign up for a free account at https://app.simfin.com/login?subscription=free.

SimFin Pricing

Check out the pricing plans at https://www.simfin.com/en/prices.

SimFin Facebook

Follow SimFin on Facebook: https://www.facebook.com/simfinofficial.

SimFin Youtube

Watch SimFin videos on YouTube: https://www.youtube.com/playlist?list=PLsfApDmF0SP4IUpD3PT9xvETpxiOP7EAu.

SimFin Linkedin

Connect with SimFin on LinkedIn: https://www.linkedin.com/company/simfin.

SimFin Twitter

Follow SimFin on Twitter: https://twitter.com/simfinofficial.

SimFin Instagram

Follow SimFin on Instagram: https://www.instagram.com/simfin_official/.

FAQ from SimFin

What is SimFin?

SimFin is a platform for stock analysis and financial data downloads, offering advanced tools for portfolio analysis, stock screening, and backtesting. With access to data for over 5,000 stocks, it is a key resource for analysts looking to optimize their investment strategies.

How to use SimFin?

To use SimFin, sign up for a free account and access a wide range of features. Utilize the stock screener to create custom filters and indicators, backtest strategies, and download financial data via API or bulk-CSV for comprehensive analysis.

What type of accounts is SimFin offering?

SimFin offers FREE, BASIC, and PRO accounts. The FREE account provides access to core features, while BASIC and PRO accounts offer additional benefits and higher-speed data connections. Detailed pricing and features are available on the Prices page of the website.

Who are the investors of SimFin?

SimFin secured funding in 2022 from IBG Risikokapitalfonds managed by bmp Ventures, an investment fund supporting innovative start-ups in Sachsen-Anhalt, Germany.

Why are there more US stocks listed than European stocks on SimFin?

SimFin is expanding its database and aims to complete the history of the US stock market by Q1 2023, European markets by the end of 2023, and Asian markets by the end of 2024.

What is a stock screener?

A stock screener is a tool that helps investors filter thousands of securities based on custom criteria. SimFin's stock screener allows users to build complex conditions with indicators and visualize financial metrics and market distributions.

What is backtesting of investment strategies?

Backtesting involves applying an investment strategy to historical data to evaluate its past performance, providing insights into its potential effectiveness.

How can I get help for the SimFin tools?

SimFin offers video tutorials and articles on the Support page of the website, providing tips and best practices for using the tools effectively.

Do I have to pay for a SimFin account?

SimFin offers a free account with access to core features, as well as paid accounts (BASIC and PRO) for additional benefits and faster data connections. Pricing details are available on the Prices page of the website.

Is SimFin a German company?

Yes, SimFin Analytics GmbH is based in Halle (Saale), Germany, and is owned by German shareholders.