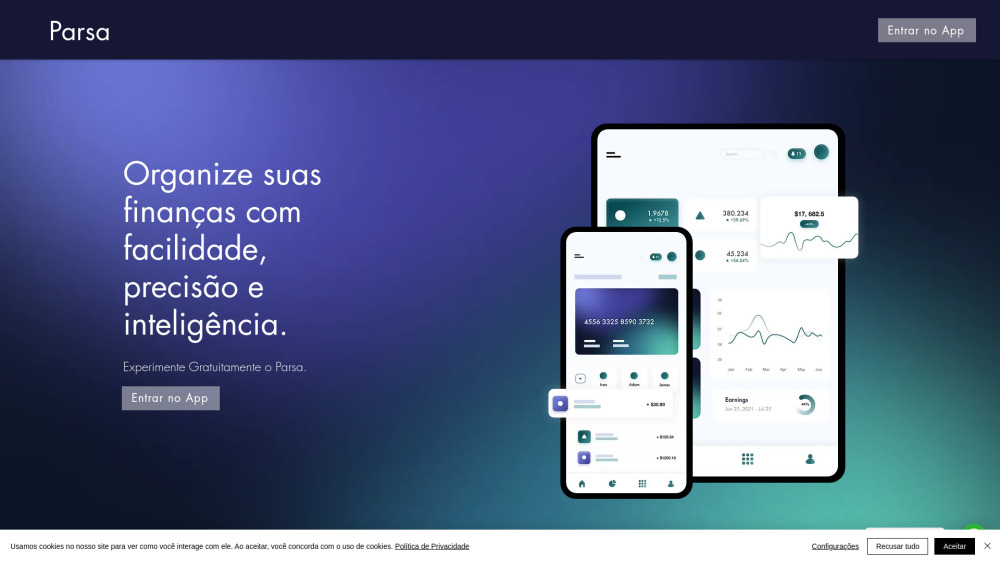

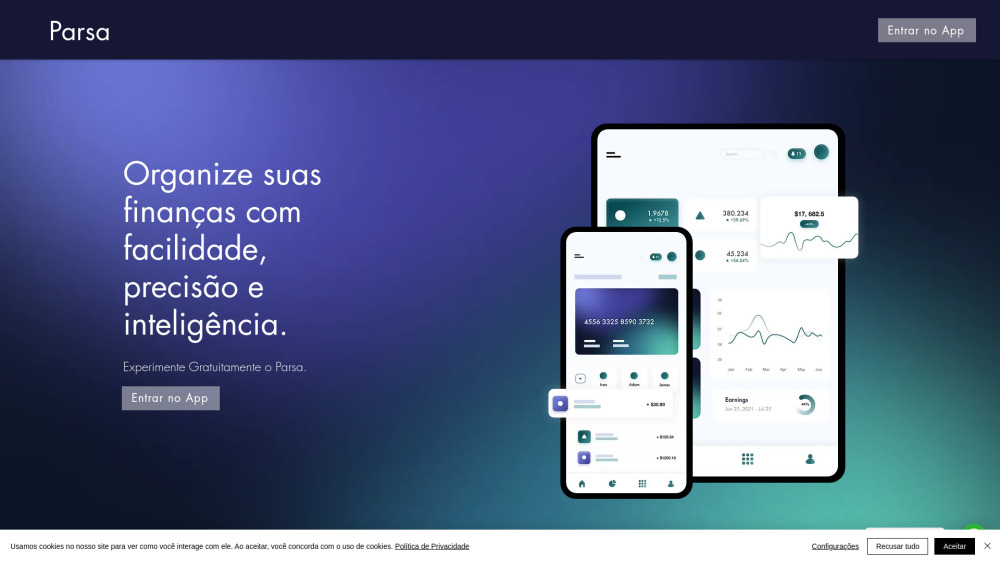

Parsa | Finanças Pessoais: Automated Finance Tool for Brazilian Market

Parsa | Finanças Pessoais no Automático: Simplify your finances with Brazil’s top automated tool for budgeting, savings, and expense tracking.

What is Parsa | Finanças Pessoais no Automático?

Parsa is a cutting-edge automated financial management platform specifically designed for the Brazilian market. By automating key financial tasks like transaction categorization, Parsa makes it easier for users to keep track of their expenses and understand their financial situation with detailed reports and visualizations.

How to use Parsa | Finanças Pessoais no Automático?

Parsa | Finanças Pessoais no Automático's Core Features

Intelligent transaction categorization

Comprehensive financial visualizations

Highly accurate financial analysis

Parsa | Finanças Pessoais no Automático's Use Cases

Easily manage personal finances with automated precision

Save valuable time by automating financial analysis with Parsa

Parsa | Finanças Pessoais no Automático Support Email & Customer service contact & Refund contact etc.

For any support inquiries, you can reach out to Parsa via email at: [email protected].

Parsa | Finanças Pessoais no Automático Company

Parsa operates under the company name: Parsa Assessoria Tecnologica LTDA.

Company address: Av. dos Andradas, 3000 Belo Horizonte - MG 30260-070.

Parsa | Finanças Pessoais no Automático Login

Login to Parsa at: https://app.parsa-ai.com.br

Parsa | Finanças Pessoais no Automático Sign up

Sign up for Parsa at: https://app.parsa-ai.com.br

Parsa | Finanças Pessoais no Automático Facebook

Follow Parsa on Facebook: https://www.facebook.com/profile.php?id=61561820769097

Parsa | Finanças Pessoais no Automático Linkedin

Connect with Parsa on LinkedIn: https://www.linkedin.com/company/parsa-financeiro/

Parsa | Finanças Pessoais no Automático Instagram

Follow Parsa on Instagram: https://www.instagram.com/parsa_financas/

FAQ from Parsa | Finanças Pessoais no Automático

What is Parsa | Finanças Pessoais no Automático?

Parsa is an AI-driven tool that assists Brazilian users in managing their finances by automatically sorting transactions and offering detailed financial insights.

How to use Parsa | Finanças Pessoais no Automático?

To get started, simply upload your bank statements, and Parsa’s AI will handle the categorization and provide tailored financial reports automatically.

How accurate is Parsa in categorizing transactions?

Parsa achieves over 99% accuracy when categorizing various financial transactions, offering one of the most reliable solutions available in Brazil.

Can Parsa integrate with different bank statements formats?

Yes, Parsa is compatible with multiple formats, such as CSV files and screenshots, with plans to expand support for PDF and Open Finance integrations soon.