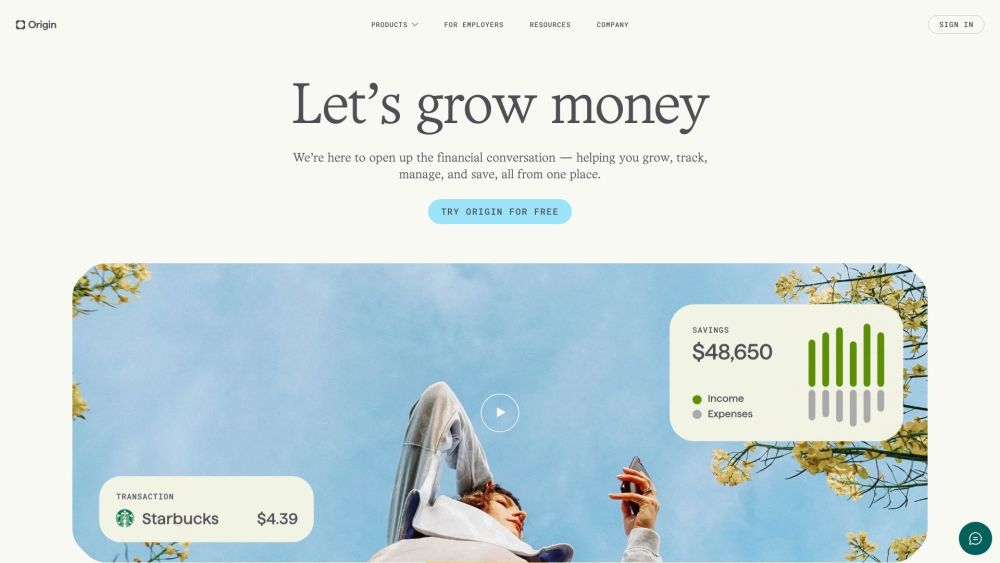

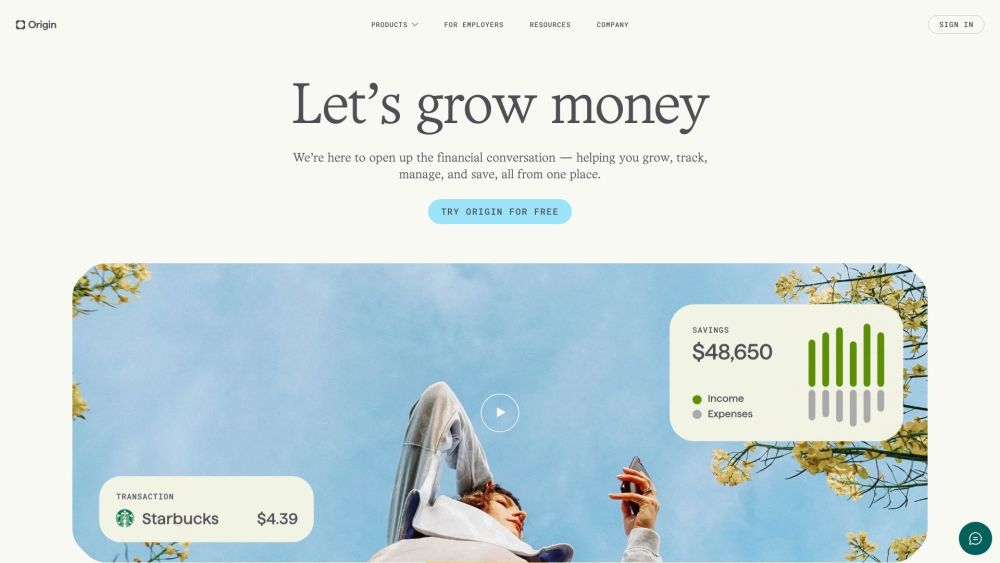

Origin: Comprehensive Money Management & Financial Growth Platform

Origin is the all-in-one money management platform. We're here to open up the financial conversation — helping you grow, track, manage, and save, all from one place.

What is Origin?

Origin is a comprehensive financial management platform designed to streamline your financial journey. With tools to help you monitor, organize, save, and grow your money, Origin simplifies personal finance by bringing all your accounts, budgeting, and investment management into one place.

How to Get Started with Origin?

Key Features of Origin

Comprehensive Net Worth Monitoring

AI-Driven Budget and Savings Insights

Instant Money Guidance via Sidekick

Certified Financial Planner™ Consultations

Automated Investing with Zero Advisory Fees

Popular Use Cases for Origin

Erasing Student Loans

Planning for a Secure Retirement

Vacation Budgeting Made Easy

Saving for Children’s Education

Launching a Small Business

Purchasing a New Car

Preparing to Buy a Home

Origin Company

Origin operates under Blend Financial Inc. dba Origin Financial.

To learn more about Origin, visit our about us page (https://www.useorigin.com/company).

Origin Login

Access your account here: https://app.useorigin.com/

Origin Sign Up

Create an account here: https://app.useorigin.com/sign-up

Origin LinkedIn

Connect with us on LinkedIn: https://www.linkedin.com/company/origin-financialsf/

Origin Twitter

Follow us on Twitter: https://twitter.com/useorigin

Origin Instagram

Check out our Instagram: https://www.instagram.com/use.origin/

FAQ About Origin

What is Origin?

Origin is an all-in-one money management platform built to empower you in your financial journey. It helps you save, invest, and manage all of your finances efficiently from one central location.

How do I use Origin?

To use Origin, simply sign up for an account and start accessing the tools for account management, expense tracking, goal setting, and personalized advice for financial success.

What is the cost of Origin?

Origin is available for $12.99 per month, which includes 24/7 financial guidance, tax support, budgeting tools, savings insights, and automated investing without additional advisory fees.

What are Origin’s standout features?

Origin offers a robust set of features, including net worth tracking, smart budget recommendations, instant money advice with Sidekick, financial planning from Certified Financial Planners™, and free automated investing.

What can I use Origin for?

Origin supports a variety of financial goals, such as paying off student debt, planning for retirement, budgeting for travel, saving for college, starting a business, purchasing a car, and buying a home.

How does Origin help with investments?

Origin Invest provides automated investment services with zero advisory fees, helping you grow your wealth and achieve your long-term financial goals.