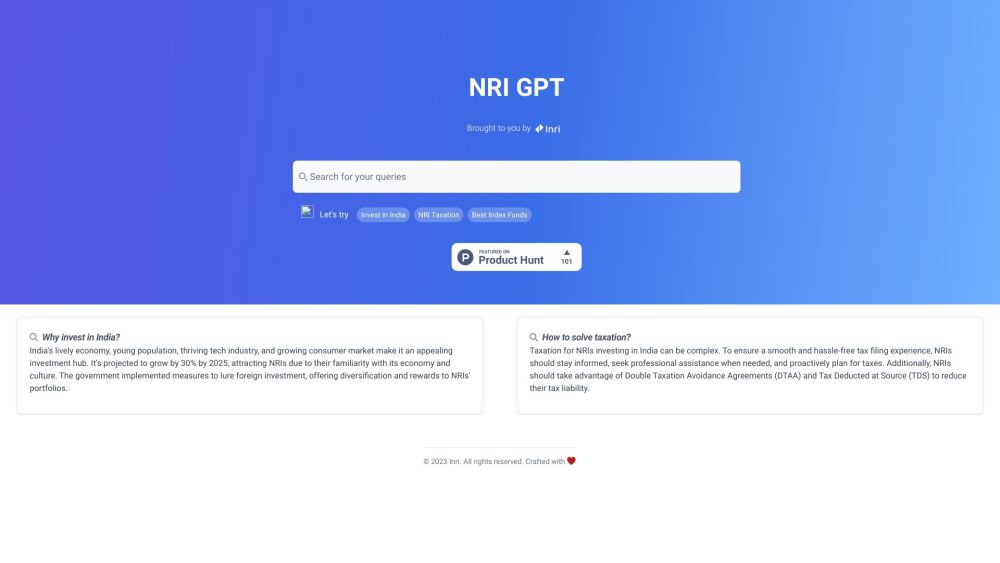

NRI GPT: AI Chatbot for NRI India Investment and Tax Queries

NRI GPT is a chatbot powered by Open AI ChatGPT that provides answers to queries related to India investing and taxation. It is designed to assist Non-Residential Indians (NRIs) in understanding and navigating the complexities of investing in India and managing their taxes.

Understanding NRI GPT

NRI GPT is an AI-powered chatbot developed by OpenAI ChatGPT, specifically designed to address queries related to investment and taxation in India. It aims to help Non-Resident Indians (NRIs) navigate the complexities of investing in India and managing their tax obligations efficiently.

How to Utilize NRI GPT?

Key Features of NRI GPT

1. Investment in India: Discover top index funds, lucrative investment opportunities, and the benefits of investing in India.

2. NRI Taxation: Gain insights into the taxation intricacies for NRIs, along with strategies to reduce tax liabilities.

3. Double Taxation Avoidance Agreements (DTAA): Learn how NRIs can leverage DTAA to lower their tax burdens.

4. Tax Deducted at Source (TDS): Understand TDS and how it helps NRIs manage their tax payments effectively.

Applications of NRI GPT

1. NRIs planning investments in India can use NRI GPT for insights on the Indian economy, tech sector, and consumer market to make informed decisions.

2. NRIs looking for tax guidance can depend on NRI GPT to navigate tax filing in India, find ways to minimize taxes, and utilize DTAA and TDS benefits.

3. Financial advisors and professionals assisting NRIs can use NRI GPT as a resource for up-to-date information on investment and taxation in India.

-

NRI GPT Company

NRI GPT is developed by the company Inri.

FAQs about NRI GPT

What is NRI GPT?

NRI GPT is an AI-driven chatbot powered by OpenAI ChatGPT, providing answers on India-related investment and taxation for NRIs, helping them manage investments and taxes.

How to use NRI GPT?

To use NRI GPT, enter your investment or tax-related query. The chatbot will offer responses and guidance. You can ask about the best index funds, investment benefits, tax regulations, DTAA, TDS, etc.

Why should NRIs invest in India?

NRIs should consider investing in India due to its robust economy, young workforce, booming tech industry, and expanding consumer market. India’s projected 30% growth by 2025 offers attractive investment opportunities.

How can NRIs manage taxation while investing in India?

Managing taxes for NRIs investing in India can be challenging. Staying informed, seeking professional help, and planning ahead are crucial. Utilizing DTAA and TDS can also help reduce tax liabilities.

What are the benefits of Double Taxation Avoidance Agreements (DTAA)?

DTAA prevents double taxation of income for NRIs. By utilizing DTAA, NRIs can avoid dual taxation on the same income, ensuring a fair and mutually beneficial tax system.

How does Tax Deducted at Source (TDS) help NRIs?

TDS is a method where tax is deducted from income at its source. NRIs benefit from TDS as it simplifies tax payments, ensures compliance with Indian tax laws, and eases tax management.