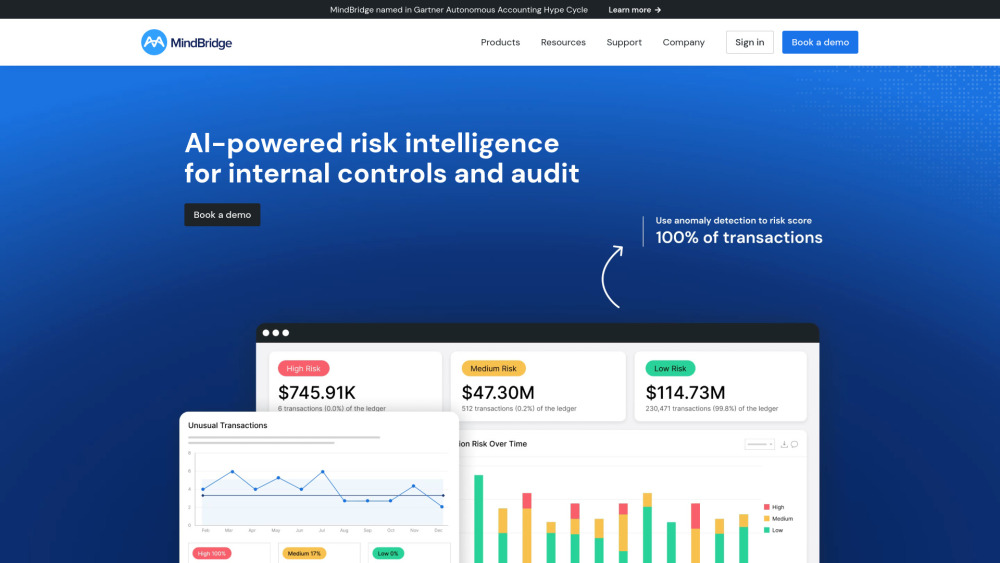

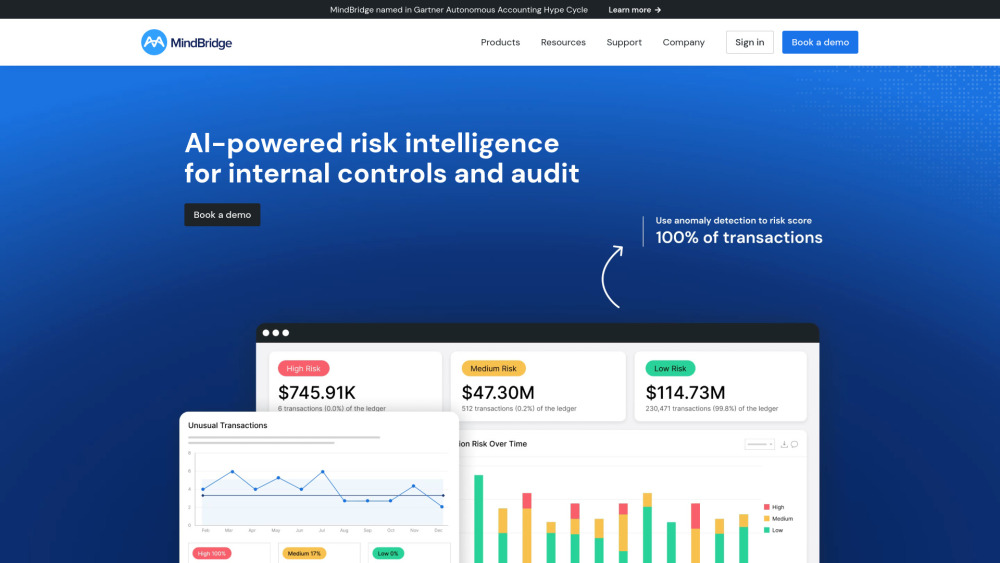

MindBridge AI: Global Leader in Financial Risk Discovery Solutions

MindBridge AI: The global leader in financial risk discovery, empowering businesses with advanced AI solutions for unparalleled financial insights.

Understanding MindBridge AI

MindBridge AI stands at the forefront of global financial risk discovery, offering advanced anomaly detection solutions. Their cutting-edge platform empowers financial professionals by identifying, analyzing, and mitigating risks within extensive financial datasets, leading to more informed decision-making and streamlined operations.

Leveraging MindBridge AI in Financial Analysis

Key Features of MindBridge AI

Automated financial transaction analysis

Detection of anomalies in financial data

Enhanced controls for improved decision-making

Practical Applications of MindBridge AI

Streamline risk identification and anomaly detection in financial datasets

Bolster financial controls and support better decision-making

-

MindBridge AI Support and Contact Information

For more contact details, visit the contact us page.

-

About MindBridge AI

MindBridge AI is based at 80 Aberdeen Street, Suite 400, Ottawa, ON K1S 5R5, Canada. Learn more about their mission and team on the about us page.

-

MindBridge AI Login

Access your account via the MindBridge AI login page.

-

MindBridge AI on Social Media

Stay connected with MindBridge AI on their social media platforms:

MindBridge AI FAQs

What is MindBridge AI?

MindBridge AI is a leading global platform specializing in financial risk discovery and anomaly detection, helping professionals navigate complex financial data with precision.

How do you utilize MindBridge AI?

By leveraging MindBridge AI, financial professionals can automate transaction analysis, detect unusual activities, and enhance control mechanisms, ultimately leading to improved decision-making.

How does MindBridge AI support financial professionals?

MindBridge AI aids professionals by streamlining the analysis of financial transactions, focusing on anomaly detection, and strengthening control environments for better-informed decisions.

What distinguishes MindBridge AI in financial risk detection?

The unique integration of machine learning, rules-based analytics, and statistical methods in MindBridge AI's platform enables swift and effective anomaly detection, setting a new standard in financial risk mitigation.