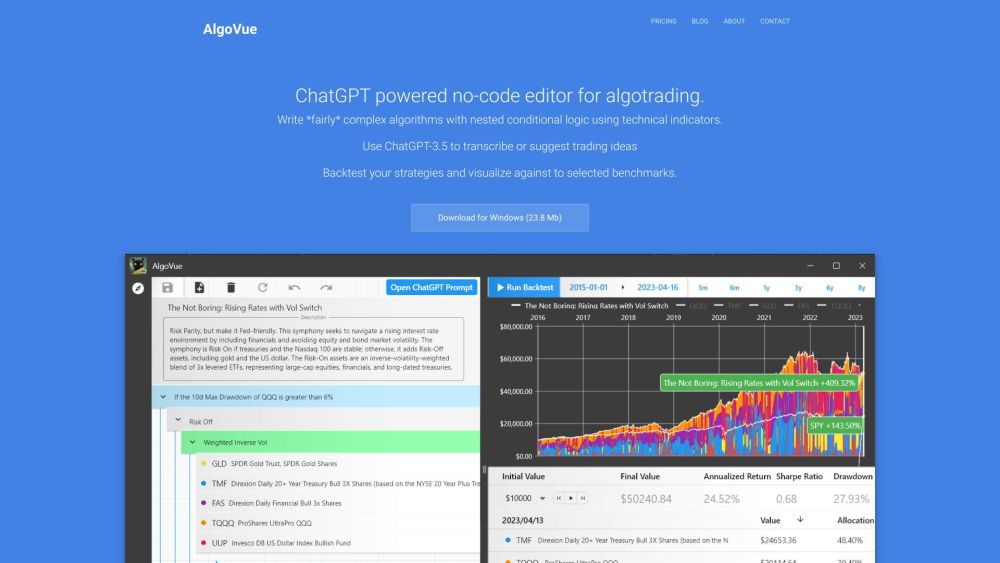

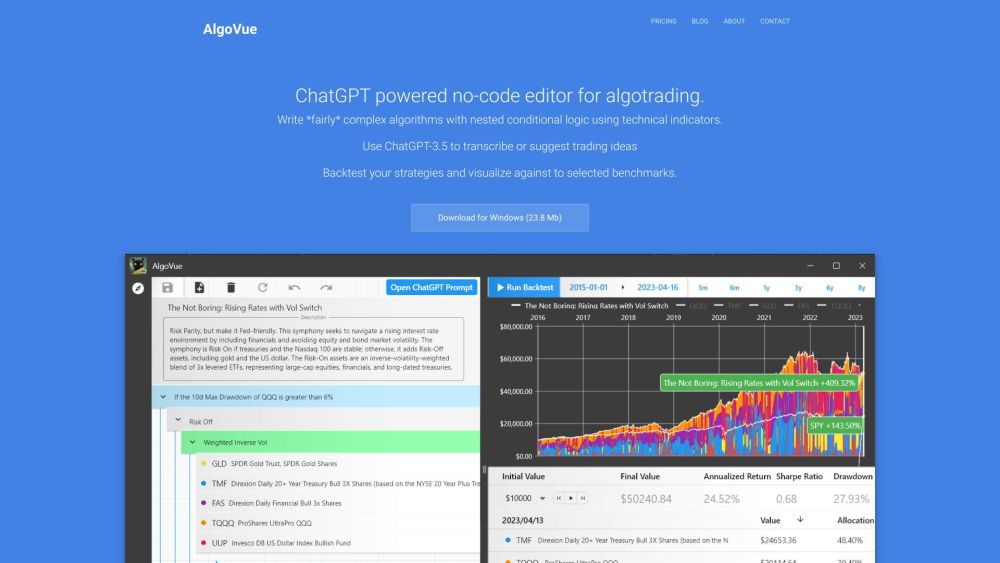

AlgoVue: No-Code Algo Trading, GPT-3.5 Chat, Backtesting, Visualization

AlgoVue: Create complex algo trading strategies with ease! No-code editor, ChatGPT-3.5 insights, and robust backtesting & visualization tools. Start trading smarter.

What is AlgoVue?

AlgoVue is an innovative no-code platform for algorithmic trading, designed to help users build intricate algorithms using technical indicators and nested conditional logic. With integrated support from ChatGPT-3.5, users can transcribe trading ideas or receive suggestions directly within the platform. Additionally, AlgoVue offers comprehensive backtesting and visualization tools, allowing users to evaluate their strategies against predefined benchmarks.

How to use AlgoVue?

AlgoVue's Core Features

No-code visual editor for algo trading

Nested conditional logic with technical indicators

Transcription and idea suggestion using ChatGPT-3.5

Backtesting and visualization against benchmarks

Export algorithms as Backtrader.py Python or TradingView Pine Script

AlgoVue's Use Cases

Portfolio rebalancing

Pairs trading

Buying the dip

Asset allocation by percentage or inverse volatility

AlgoVue Support Email & Customer service contact & Refund contact etc.

For more contact information, visit the contact us page.

AlgoVue Company

Company name: MyApp Ltd.

For more details about AlgoVue, please visit the about us page.

AlgoVue Login

Login here: https://algovue.app/

AlgoVue Sign up

Sign up here: https://algovue.app/

AlgoVue Pricing

For pricing information, visit: https://algovue.app/pricing/

AlgoVue Facebook

Follow us on Facebook: https://facebook.com/cloudcannon/

AlgoVue Youtube

Subscribe on YouTube: https://youtube.com/cloudcannon/

AlgoVue Twitter

Follow us on Twitter: https://twitter.com/cloudcannon/

FAQ from AlgoVue

What is AlgoVue?

AlgoVue is a no-code editor for algo trading, allowing users to create complex algorithms using technical indicators and nested conditional logic. Integrated with ChatGPT-3.5, it offers transcription and idea suggestions, along with backtesting and visualization against benchmarks.

How to use AlgoVue?

To use AlgoVue, download the Windows desktop app. The intuitive interface supports algorithm creation with technical indicators and nested logic. ChatGPT-3.5 assists with transcription and idea generation. Strategies can be backtested and visualized against benchmarks, and exported as Backtrader.py Python or TradingView Pine Script.

How do I use AlgoVue?

Download the Windows desktop app. Create algorithms using nested logic and technical indicators, utilize ChatGPT-3.5 for transcription and ideas, backtest and visualize strategies, and export them as Backtrader.py Python or TradingView Pine Script.

What are the core features of AlgoVue?

AlgoVue provides a no-code visual editor, nested conditional logic with technical indicators, ChatGPT-3.5 transcription and idea suggestions, backtesting and visualization against benchmarks, and export capabilities for algorithms.

What are the use cases for AlgoVue?

AlgoVue is ideal for portfolio rebalancing, pairs trading, buying the dip, and asset allocation by percentage or inverse volatility.